Spirits sales are in a slump, and a squeeze on spending power is to blame. “Inflationary pressures continue to weigh on the spirits category,” notes Hassan Atir, NIQ analytics executive.

Not even a 2.1% increase in average price per litre has been enough to keep category value in the black. It’s down £128.8m on volumes that have slid 4.3%.

Given a bottle of gin, vodka or whisky is typically an outlay of £20-plus, it’s little surprise cash-conscious shoppers are thinking twice. “Looking at the money you have to pass over at the till, a bottle is quite a considered purchase,” admits Ian Peart, commercial director at Pernod Ricard UK.

“People are having to manage their spend – not just on booze but also in other categories. Alcohol is always on the discretionary end. So, if your income is challenged, you do look at things like that.”

That’s bad news for suppliers, which are facing inflationary pressures of their own – including a growing duty burden, rising input costs and EPR fees that disproportionately punish glass bottles.

The biggest brands have been hit hardest by attempts to pass on costs. All of the top 10 are in value decline and only Jack Daniel’s has grown volumes.

One major brand that’s avoided the malaise is Jameson. The Irish whiskey has added £10.6m on volumes up 17.5% – which Peart attributes to its partnership with the English Football League and a strong innovation pipeline. That includes Triple Triple Chestnut Edition launched in February.

Innovation has also been front and centre in RTDs. Amid a blitz of new products and players, the market has added £76.2m on volumes up 9.4%.

One new brand is TikTok sensation Buzzballz. It’s worth £24.6m following a near-800% uplift in volumes. Greater distribution and innovation have been key to its meteoric rise. Its 1.75l Biggies of pre-mixed cocktails are now in major mults including Tesco, Sainsbury’s and Morrisons.

Also on the up is Au Vodka. Its cans have added £16.8m on volumes up 43.8%. That’s after its May launch of caffeinated range Ultra (see Top Launch, below). It was followed in October by Alcohol-Free Blue Raspberry 0.0% in a 4x330ml pack.

Au is reflective of the diversity in RTDs that Peart describes as “unbelievable”. He adds: “If you look at where the category started it was mainly just G&Ts in cans, and now you’ve got huge variety of spirit mixers and cocktails in cans, as well as all sorts of other formats.”

That dynamism is exactly why RTDs are in rude health.

Top Launch 2025

Ultra | Au Vodka

Au’s 5% abv vodka-sodas and 8% abv cocktails have helped make the brand a giant in RTDs. This year, it upped the ante with its 7% abv Ultra lineup. Providing 25ml of caffeine per 100ml, Blue Raspberry and Strawberry Burst (rsp: £3.79/500ml) promise a “strong yet smooth serve that’s packed with flavour”. Unveiled in May, Ultra is already “attracting new shoppers and driving incremental sales”, according to Au sales director Tom Smith.

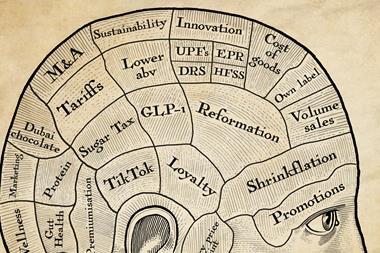

How the psychology of price hikes has played out on shelves

- 1

- 2

- 3

Currently reading

Currently readingAlcohol - spirits 2025: Mainstream spirits feel the squeeze

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

No comments yet