Each of the categories covered in our Top Products report features a Top Launch – the product most significant to its respective category in 2025.

From pastry toasties to Palestinian lager and Dubai chocolate to deodorant, this is every Top Launch from the year and why we chose it.

Check out our main feature with a full breakdown of category performances here

Alcohol - beer & cider

Sun & Stone Lager | Brewgooder

Brewgooder chose to put purpose ahead of profit this year. Sun & Stone Lager (rsp: £27/12x330ml) is in support of Palestine’s Taybeh Brewing Co. Rolled out in September, proceeds from its sale go to Taybeh’s local community in the West Bank, as well as to the Disasters Emergency Committee. So far, “tens of thousands of pounds” have been raised, helping to support Palestinians “at a time when tangible acts of solidarity are needed more than ever”, says Brewgooder co-founder James Hughes.

Alcohol - spirits

Ultra | Au Vodka

Au’s 5% abv vodka-sodas and 8% abv cocktails have helped make the brand a giant in RTDs. This year, it upped the ante with its 7% abv Ultra lineup. Providing 25ml of caffeine per 100ml, Blue Raspberry and Strawberry Burst (rsp: £3.79/500ml) promise a “strong yet smooth serve that’s packed with flavour”. Unveiled in May, Ultra is already “attracting new shoppers and driving incremental sales”, according to Au sales director Tom Smith.

Alcohol - wine

La Casera | SBF GB&I

Suntory Beverage & Food GB&I continued its push into alcohol in April with La Casera, a tinto de verano in a 330ml can (rsp: £2.50). It combines wine and soda in a lower abv serve to appeal to “UK consumers wanting an aperitivo moment with friends”. Red Wine, Soda & Lemon (3.4% abv) and White Wine, Soda & Lemon (2.5% abv) are available across grocery. “A lot of ready-to-drink options are spirit-led, which means there’s a clear opening for something new,” says SBF GB&I.

Baby & infant products

Superstars | Little Dish

Big things are happening at Little Dish. The kiddies’ chilled ready meal brand made its frozen food debut in April with the launch of Superstars, star-shaped chicken nuggets made with Red Tractor-certified British chicken breast wrapped in a gluten-free crumb. Each nugget is laced with “hidden” cauliflower to contribute to little ones’ 5 a day (a struggle, as parents will attest). They also contain half the salt of regular nuggets. Having first rolled into Ocado, they’ve since won a national listing at Tesco.

Bagged snacks

Non-HFSS Walkers | PepsiCo

In 2024, PepsiCo’s eggheads reformulated the entire Doritos range to be non-HFSS. This year, they turned their attention to Walkers. They employed “innovative R&D processes” to create “a different balance of flavours and seasonings”, PepsiCo announced in August. As a result, Walkers crisps including Salt & Vinegar, Prawn Cocktail and Smoky Bacon are now HFSS-compliant. But Cheese & Onion and Ready Salted aren’t. They require “a little more work”, according to the supplier.

Read more:

-

The 20 fastest growing and shrinking categories of 2025

-

Food’s market share winners and losers of 2025

Bakery & bread

Jason’s Sourdough Crumpets | Geary’s

Unveiled in September, Jason’s Sourdough Crumpets (rsp: £1.60/six-pack) are a sign of owner Geary’s ambition to shore up the brand’s explosive growth with a diverse portfolio. Fresh out of the bakery’s new £36m factory, the launch combines innovation with tradition, says Jason’s. Playing to the brand’s clean label strengths, Crumpets contain just flour, water, salt and fermented wheat flour, while offering the “distinctive tang of real sourdough”.

Batteries

Eco Rechargeable | Varta

Rechargeable batteries are more sustainable than single-use ones. But their environmental benefits could go further – as proven by the Varta Eco Rechargable range, which launched earlier this month. AA and AAA (rsp: £11/four-pack) are made from 25% recycled materials. The housing of the two chargers – the four-battery Pro (rsp: £23.99) and eight-battery Multi (rsp: £35.49) – are made from 75% recycled materials. And the greener credentials come at no cost to performance, Varta stresses.

Biscuits & cakes

Fox’s Chocolatey Dubai Style | FBC UK

Dubai chocolate has been “one of the biggest foodie trends of the past year”, says FBC UK. So, to capitalise on the “millions of social media posts”, the supplier launched Chocolatey Dubai Style Pistachio (rsp: £2.65/130g) in July, chocolate shortcake biscuits with a pistachio cream centre, coated in milk chocolate. Having debuted in Tesco, the treats rolled out to Sainsbury’s, Morrisons and Waitrose in September. And they’ve been a hit, taking £1.3m in their first 12 weeks.

Canned & ambient goods

Insalatissime | Rio Mare

Rio Mare tapped consumer desire for Italian brands, along with the trend for healthy, protein-rich meals that fit busy lifestyles, for its May launch of Insalatissime tuna saladsnacks. “Today’s shoppers want food that’s quick and easy but without compromising on quality or nutrition,” said Igor Viteznik, sales & marketing manager of Bolton UK, Rio Mare’s parent. The range (rsp: £3/160g) of six tuna salads in a recyclable bowl includes Cous Cous, Sweetcorn, Lentils, Messicana, Bean and Quinoa options.

Cereal

Only 1 Ingredient Corn Flakes | M&S

Ingredients panels don’t get much simpler than just “corn”. In March, against a backdrop of concerns over UPFs and lengthy ingredients lists, Marks & Spencer unveiled its squeaky-clean-label Corn Flakes. The NPD (rsp £2.50/325g) was among the first products in the retailer’s Only… Ingredients range. It also features Multigrain Hoops with five ingredients and Choco Hoops with six. The concept certainly seems to be working: Corn Flakes have performed “really well”, M&S says.

Confectionery - chocolate

Pistachio Milk Choc Dates | Forest Feast

Grocery has been going nuts for pistachios since the Dubai-style chocolate trend took off. For this novel take on the craze, Forest Feast covers dates in pistachio butter, wafer and Belgian milk chocolate. It’s not just the product’s novelty or decadence that’s won this treat our chocolate launch prize. It’s also one of several innovations from Forest Feast that have helped catapult the brand into the big time. Retail sales value passed the £20m mark earlier this year.

Confectionery - sugar

Squashies Drumchick | Swizzels

With sky-high cocoa prices pushing up Easter egg prices as much as 50% in 2025, Swizzels spied an opportunity. “Easter is usually associated with chocolate, but we’ve noted rising demand for alternative sweet treats,” said trade marketing manager Clare Newton in March. She was announcing the launch of Squashies Drumchick (rsp: £1.15/120g). The chick-shaped, orange & pineapple-flavoured foam sweets hit the mark, helping to drive overall Squashies volumes up 2.4% over the full year.

Cooking sauces

The Classics | Gymkhana Fine Foods

Acclaimed London restaurant Gymkhana launched its premium retail range in 2022, carving out a niche in “elevated” Indian cooking sauces. It went on to win listings in Sainsbury’s, Waitrose, Whole Foods Market and Ocado. In May, it expanded its lineup with its take on Brits’ “much-loved classics”. Korma, Tikka Masala and Madras (rsp: £6.75/300ml) are “crafted to the same exacting standards as our two Michelin-starred dishes”, the brand claims.

Dairy - butters & spreads

Kerrygold Sweet Spreadable | Ornua Foods

‘Salted’ and ‘unsalted’ don’t cut it with some Brits wanting excitement at the breakfast table. That’s why flavoured butters & spreads have become a hot trend in dairy. Kerrygold tapped the craze in March with the launch of Sweet Spreadable in Maple Syrup and Maple Syrup & Cinnamon tubs (rsp £2.95/150g). Consumer awareness, trial and buy-in have grown steadily since launch, says Ornua, and the two variants are attracting new shoppers to the category.

Dairy - cheese

Babybel Protein | Bel UK

Capitalising on “relatively untapped” opportunities in protein-rich cheese, Bel UK launched Babybel Protein (rsp: £2.45/6x20g). Unveiled in May, it provides 26g of natural protein per 100g, compared with the 22g of Babybel Original. And it promises the same “creamy taste and nutritional goodness of the original”. The launch of the 100% cheese snack coincided with the brand launching its fully home-recyclable paper wrap, which has replaced cellophane.

Dairy - drinks

Unhomogenised Whole Milk | Tom Parker

This “nostalgic nod” to old-school milk differs from standard milk due to its cream top, says Tom Parker Creamery. Unhomogenised Free Range Whole Milk (rsp: £2.15/750ml) is how “milk used to be”, by not having its fat content distributed evenly. The result is a “cream plug” that rises to the top of the glass bottle and varies in thickness depending on the time of year. Unveiled in September, Tom Parker describes the product as a response to calls for “minimally processed” dairy.

Dairy - yoghurt

Petits Filous Natural + Calcium | Yoplait

Petits Filous Natural + Calcium & Vitamin D landed in September. The unsweetened yoghurt (rsp: £1.95/450g) promises to be “smooth, mild and creamy”, with calcium and vitamin D crucial for the healthy development of children. The brand says it’s “raising the bar on fortification and nutrition” as diseases such as rickets surface for the first time in decades. The calcium intake of children has fallen significantly over the past 10 years, warns Petits Filous owner Yoplait.

Eggs

Better Eggs | Fairburn’s Eggs

Pitched as a competitor to the likes of Noble Foods’ Happy Egg Co, Fairburn’s Better Eggs rolled into in Asda in October. They’re sourced from RSPCA Assured hens that live “the better way”, say Fairburn’s. The free-range birds “explore fields, roost in spacious sheds and eat the best grain that we’ve milled ourselves – part of “a fully traceable food chain that reduces the reliance on imported feed”. The eggs boast a “rich, golden yolk – ideal for versatile dishes, poaching, baking or frying”.

Fresh - fruit & veg

Lion’s Mane Mushrooms | Sainsbury’s

Lion’s mane in its natural form hit a national supermarket’s shelves for the first time in March when Sainsbury’s rolled these 200g punnets (rsp: £5) into its stores. It’s about time, given how use of the mushroom – which is purported to boost mood, memory and cognitive function while easing symptoms of anxiety – elsewhere in grocery has exploded in recent years. Grown by Kent organic producer Urban Farm-It, the mushrooms are billed as having a delicate flavour and a dense, meaty texture.

Fresh - meat, fish & poultry

Guinness bacon and sausage | Finnebrogue

The Guinness boom is over, some have warned. Finnebrogue clearly disagrees. It expanded its partnership with the stout giant in September, launching Guinness Unsmoked Back Bacon (rsp: £2.75/200g) and Guinness Premium Pork Sausages (rsp: £3.75/400g). The gluten-free sausages are made with British and Irish pork and caramelised red onion. The bacon rashers are nitrite-free. They boast a deep colour from the stout and a sweetness from treacle. Perfect for a fry-up on the morning after.

Frozen - ice cream

Reese’s Ice Cream Bites | Brand of Brothers

US candy brand Reese’s made its UK ice cream debut last winter. Its tubs and sticks were the result of a licensing deal between owner Hershey and Brand of Brothers. This September, a new format joined the lineup. Peanut Butter & Milk Chocolate Ice Cream Bites (rsp: £5/228g) comprise eight individually wrapped portions. Each provides 87 calories. “We saw ice cream snacking as a huge but untapped opportunity for Reese’s,” says Carys Delve, Brand of Brothers marketing manager.

Frozen - food

Quorn reformulation | Marlow Foods

Quorn answered two powerful consumer demands in August: fewer ingredients and more protein. In a bid to address concerns about UPFs, the brand reformulated its two bestselling frozen lines. Quorn Mince and Quorn Pieces now contain only four and three ingredients respectively. The relaunch was backed by new-look packaging that signposts the products as ‘high in protein with no artificial ingredients’. Quorn Swedish Style Balls began making the same claim later in the year.

Home baking

Fuel10K baking mixes | Premier Foods

Protein breakfast brand Fuel10K branched out into home baking at the start of 2025. It launched Chocolate Muffin Mix (150g/makes six) and Original Pancake, Waffle & Crepe Mix (200g/makes eight), which provide 10g and 15g of protein per serving respectively. Both lines rolled into Tesco with an rsp of £2.89. “The entire range is designed to expand the category beyond traditional baking mixes, which are dominated by cakes,” says the brand.

Hot beverages

Craft Instant Coffee| Grind

Having successfully launched ground coffee and pods, it was only a matter of time before Grind added premium instant. Regular and Decaf (rsp: £6.50/90g) debuted in September. The duo use the same ethically farmed arabica beans as Grind’s other lines. The beans are roasted, ground, brewed and slowly freeze-dried into soluble granules. Those are mixed with premium microground beans to give the instant coffee a “fuller body and richer flavour profile”.

Household - cleaning

Cif Infinite Clean | Unilever

Probiotics are good for your gut – and for your home’s surfaces, says Unilever, which unveiled Cif Infinite Clean in April. It’s an all-in-one cleaning spray that contains probiotics, which remain inactive until they encounter dirty surfaces. Then they germinate and feed on the grime. Available in Lime & Lemongrass, Lavender & Eucalyptus and Sensitive Lotus & Mineral Salt, Cif Infinite Clean comes as a reloadable spray device and refill canister – both in 280ml and 590ml formats (rsps: from £3).

Household - paper products

Cheeky Panda rebrand | Cheeky Panda

Clocking up annual loo roll sales of more than £7m, Cheeky Panda has already made a splash with its bamboo paper products. But the business wants to further ramp up its efforts to make bamboo mainstream. Hence October’s rebrand that dropped “The” from the brand name, put more emphasis on its panda logo, and made greater use of colour. “Sustainability isn’t green or beige any more,” says Cheeky Panda chief executive Julie Chen. “Bamboo deserves to be celebrated, not muted.”

Meat-free

Omami Chickpea Tofu | This

In September, alt-meat brand This added its take on tofu, using chickpeas rather than soya. With chickpea content of over 70%, Omami Chickpea Tofu (rsp: £2.95/200g) is touted as naturally low in satfat and high in protein. It plays to the growing preference for foods with minimal processing, while being “deliciously creamy on the inside and beautifully crispy on the outside”. The early signs are positive. In its first four weeks in Sainsbury’s, it accounted for a third of new shoppers to tofu, says This.

Oil

Filippo Berio 100% Natural Spray | Salov

Filippo Berio’s 100% Natural Spray (rsp: £4.99/200ml) hit shelves in June in two variants. Unlike rival products, they contain no water or emulsifiers – just 100% olive oil. Pitched as a “mess-free, portion-controlled way to enjoy the goodness of high-quality olive oil”, Extra Virgin is designed to add “rich and robust flavour” to salads. Mild & Light – made from refined and extra virgin olive oils – is described by the brand as a “perfect companion” for air-fried, grilled and baked dishes.

Personal care - beauty

Rimmel Multi Tasker Jelly Crush | Coty

‘Jelly donut blush’ was named a viral TikTok trend by Glamour in 2024. It involves using just the right amount of jelly-like highlighter and blush to create perfectly highlighted, glowy – or ‘glazed’ – cheekbones. In January, Rimmel jumped on the trend with the launch of Multi Tasker Jelly Crush for both lips and cheeks. Available at just £10.99 for 8.5g in Superdrug, it plays perfectly into the rise in budget beauty. With those credentials, Rimmel might just have crushed it.

Personal care - haircare

Advanced+ | Hairburst

Hairburst gained a loyal following with its Advanced+ hair supplement. However, its shoppers also wanted “products to help with additional support repair and protection of their hair from the outside”, says the brand. So, its Advanced+ Shampoo (rsp: £25.99/350ml) and Leave-In Treatment Mask (rsp: £38.99/100ml) launched in September. Designed to work with the supplement, they “address the root causes of hair loss and damage”. Consumers are seeing visible results after the first wash, says Hairburst.

Personal care - health

Pineapple Flavour | Symprove

Gut health shots aren’t necessarily known for their taste. One brand looking to change that perception is Symprove, which added its Pineapple flavour dosing bottle (rsp: £22.99/500ml) in May. Joining the brand’s Original, Mango & Passion Fruit and Strawberry & Raspberry flavours, it aims to offer taste that sets it apart from rivals. Stockist Holland & Barrett has been “absolutely delighted” with initial response and sales have exceeded initial expectations by more than 50%, says Symprove.

Personal care - hygiene

Sure | Whole Body Deo Stick Fresh Citrus

Sure Whole Body Deo made its debut in January, designed to be used on “boobs, feet and beyond”. It was made with “exclusive Odour Adapt technology that adapts to the varying odours found in different parts of the body”, said Unilever at the time. The premium lineup is available in spray (100ml), stick (40ml) and quick-drying lotion formats (75ml) – all with an rsp of £5.25. Fragrances are Wild Rose and Fresh Citrus for women and Ocean Rush and Active Fresh for men.

Personal care - oral care

Refillable toothpaste dispenser | Mighty

Mighty debuted in June, claiming a category first for its refillable toothpaste dispenser and plastic-free refills. Available from Mighty’s website, the dispenser (£9) is available in Coral, Minty Blue and Mighty Blue variants – all featuring post-consumer recycled plastic. They’re “designed to look good on any bathroom counter”, says the brand. Refills of English Mint Toothpaste come in a bundle of 3x50ml (£18) and promise “active ingredients that protect and support your oral microbiome”.

Petcare

Gut Health Test | Pooch & Mutt

Gut health is a hot trend not just in food and drink. It’s also informing petcare NPD – including this Gut Health Test (rsp: £69.99) from Pooch & Mutt. Available since August, it’s the “first of its kind” in UK retail, the brand claims. The test is backed by gut health testing business Biome9, which Pooch & Mutt acquired in January. It uses “cutting-edge science, research and AI to deep-dive into dogs’ unique microbiomes, to identify gaps or imbalances”, adds the brand.

Pizza

Collezione Romana | Crosta Mollica

Pizza’s becoming posh. And it doesn’t come much posher than this Crosta Mollica launch. In September, the brand tapped the trend of regional world cuisine with its chilled Collezione Romana range (rsp: £8.50/32cm). Available from Tesco, Sainsbury’s and Waitrose, it comprises Portofino (buffalo mozzarella, fior di latte & cherry tomatoes), Bosco Di Alba (garlic sauce, truffles & mushrooms ) and Bolzano (spiced sausage & red onion). They’re Roman-style pizza, meaning they boast a thin, crispy base.

Ready meals

GLP-1 meals | Field Doctor

Specialist meal delivery service Field Doctor claimed a UK first in April with the launch of its meals for GLP-1 users. Created in collaboration with obesity specialist dietician Abby Hookey, the smaller portions “cater for the needs, symptoms and side effects of those using weight loss treatments and programmes”. The 12-strong range includes Chicken, Pea & Asparagus Risotto and Italian Meatballs. Each is below 350 calories but “nutrient dense” and “high in protein to maintain muscle mass”.

Rice, noodles & pasta

Itsu chilled ready meals | Itsu

In a busy year of NPD by Itsu, this posh ready meal range hit Tesco’s chillers in October. Created in partnership with Bakkavor, the six “restaurant-inspired” microwaveable dishes (rsp: £6/370g-395g) are takes on Asian favourites. The likes of Katsu Chicken Brown Rice, Korean-Style Spicy Pork Noodles and Chicken Pad Thai Noodles boast a “nutritious vegetable mix” and provide “a quick, complete meal for one that’s ready in four minutes”, says Itsu. They’re delicious, too.

Savoury pastries

Ginsters Pastry Toasties | Samworth Bros

One in three shoppers struggle to find a quick, tasty and affordable hot lunch option, claims Ginsters. Its solution is Pastry Toasties. Featuring 100% British meat, the “game-changing” lineup is made from a unique type of pastry that goes golden brown in a toaster in four minutes – without leaking. Smoked Ham & Cheddar, Tomato, Basil & Mozzarella, and Chicken, Pesto & Mozzarella (rsp £2.50/130g) made their debut in Tesco in October, ahead of a wider rollout scheduled for 2026.

Soft drinks - bottled water, squash & cordial

Ribena reformulation | SBF GB&I

Ribena lovers were left divided over the brand’s reformulated recipe in March. Blackcurrant juice had been reduced slightly in favour of natural blackcurrant flavour, and its polydextrose thickener had been removed. Some shoppers complained Ribena tasted “entirely different”, but the brand insists most prefer the new recipe. “The key ingredients remain,” says head of marketing Sarah Fleetwood. “We’ve just rebalanced the recipe to deliver more of the unique Ribena taste our consumers love.”

Soft drinks - carbonates & energy drinks

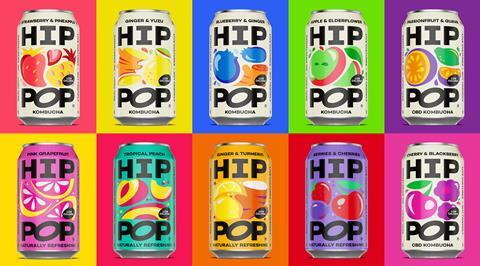

Hip Pop relaunch | Hip Pop

Gut-friendly soda challenger Hip Pop unveiled a major rebrand in March. The overhaul of its 330ml cans led to “a bold design, vibrant fruit illustrations and packaging that stands out”, the brand said at the time. It came as Hip Pop sought to build on major distribution and sales gains made in 2024 for its low-calories sodas, kombuchas and CBD drinks. “People want real ingredients, real taste and real refreshment,” according to Hip Pop co-founder Emma Thackray.

Soft drinks - juices & smoothies

Plenish Kids | CarlsbergBritvic

Plenish claimed a category first in April, unveiling its two-strong Kids range of juice shots. Berry and Mango (rsp: £1.75/60ml) are fortified with essential vitamins and minerals, with no added sugar or preservatives. They’re designed to support the wellness and development of children between four and 11. Each shot provides 100% of a child’s recommended daily intake of vitamin D, vitamin C, iron and zinc. The shots last outside the fridge for eight hours, making them suitable for packed lunches.

Soup

Dozz | FoodVision

Romanian supplier FoodVision claimed to have “broken new ground” in UK food-to-go in September. It launched Dozz, a 10-strong range of ready-to-drink chilled soups. Packed in a 310ml ringpull can (rsp: £2.50), the likes of Gazpacho, Yogurt & Mint, Tomato and Broccoli are aimed at time-poor Brits looking for convenient healthier food options. Designed to be drunk straight from the pack, the soups are low in calories and free from preservatives and artificial colourings.

Sports nutrition

Huel Lite | Huel

With use of GLP-1 weight-loss jabs booming in the UK, demand for low-calorie yet nutritious meal replacements is growing. Enter, Huel Lite. The RTD shake comes in Chocolate, Banana and Strawberry – providing just 190 calories. Each is made with pea and faba bean protein and packs 25g of protein, 6g of fibre and 26 essential vitamins and minerals per 500ml bottle (rsp: £3.50). Huel Lite rolled into Ocado and WH Smith in October. It’s due to be in Tesco early next year.

Spreads & jams

Hilltoppers | Hilltop Honey

Hilltop wants to make honey cool again. “Most honey products talk to traditional buyers, but they’re not attracting or recruiting younger shoppers,” explains founder Scott Davies. As such, the brand turned its attention to trendy flavours in the spring with the Hilltoppers lineup (rsp: £2.75/225g) . The “unique, creamy” Chai Spiced, Cocoa Honey and Pink – coloured with carrot and sweet potato concentrates – were created to “reignite” the honey market.

Table sauces

Branston Chilli Piccalilli | Mizkan

Brands love to infuse traditional food with a modern twist and pickle past master Branston is no exception. In May, it unveiled the first flavour extension for its Piccalilli. Chilli (rsp: £2.20/360g) combines the original’s “classic mustardy tang” with “an exciting chilli kick”. It was developed to “re-engage with our core audience and bring excitement to the Branston shelf”, according to brand manager Danielle Fairey. Branston shoppers “can be quite traditional” but they “occasionally like a bit of adventure”.

Vaping & tobacco

No Saint | No Saint

In stark contrast to garish Chinese vaping brands, Canada’s No Saint takes a stylish – and safer – approach to the market. Its chic pod device (rsp: £19.99) made its UK debut in May with refills in “adult-focused” flavours including Jasmine Tea, Iced Matcha Latte, Limoncello and Lychee Nectar (rsp: £11.99/two-pack). No Saint promises “no microplastic filler foam, burnt cotton wick or heavy-metal chimney”, and publishes all its chemical analysis and device emissions data.

No comments yet